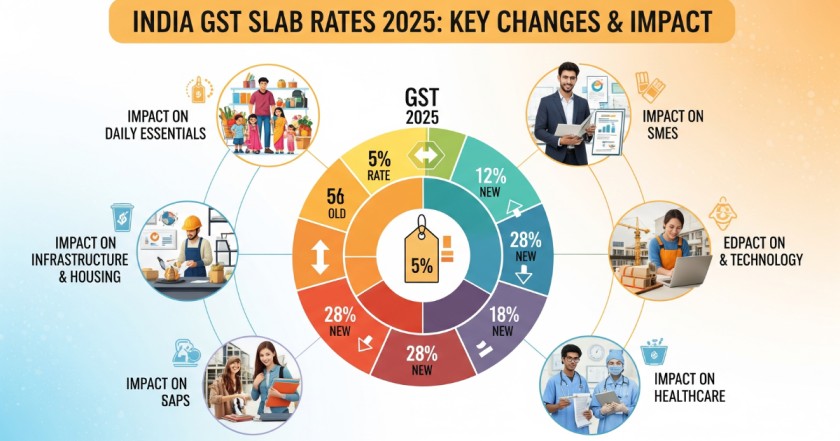

India’s Goods and Services Tax (GST) system is undergoing a major transformation. On September 4, 2025, the Union Cabinet approved a ₹1,500 crore incentive scheme to boost critical mineral recycling, while the GST Council rolled out significant reforms. Announced during the 56th GST Council meeting on September 3-4, 2025, these changes aim to simplify the tax structure and reduce rates on essential goods. Effective from September 22, 2025, the “Next-Gen GST Reform” promises to ease living costs and support the Aatmanirbhar Bharat vision. This article breaks down the new GST slabs, highlights key rate cuts, and explores their impact on consumers and businesses.

New GST Slab Structure

The GST Council has revamped the tax framework. The earlier four-tier system (5%, 12%, 18%, and 28%) is now streamlined into a simpler structure. The updated slabs are:

- 0% Slab: Covers exempt essentials like food grains and education materials.

- 5% Slab: Applies to daily necessities and basic goods.

- 18% Slab: Targets standard goods and services.

- 40% Slab: Reserved for luxury and sin goods.

This overhaul eliminates the 12% and 28% slabs for most items. Approximately 99% of goods previously taxed at 12% now fall under 5%, while 90% of 28% slab items shift to 18%. The 40% rate applies to a limited category, including tobacco and high-end vehicles.

Read This Also: Equity vs. Debt Financing: What’s Right for You?

Key Rate Reductions

The reform focuses on making life more affordable. Significant rate cuts span multiple sectors, based on announcements and posts from the Press Information Bureau (PIB) on September 4, 2025. Highlights include:

- Daily Essentials:

- Hair oil, shampoo, toothpaste: Reduced from 18% to 5%.

- Butter, ghee, cheese: Dropped from 12% to 5%.

- Pre-packaged namkeens: Lowered from 12% to 5%.

- Agriculture and Farmers:

- Tractor tyres and parts: Cut from 18% to 5%.

- Micro-nutrients and pesticides: Reduced from 12% to 5%.

- Drip irrigation systems: Down from 12% to 5%.

- Healthcare:

- Individual health and life insurance: Slashed from 18% to 0%.

- Medical-grade oxygen: Decreased from 12% to 5%.

- Diagnostic kits: Lowered from 12% to 5%.

- Automobiles:

- Petrol, diesel, CNG cars (up to 4000cc): Reduced from 28% to 18%.

- Three-wheeled vehicles: Cut from 28% to 18%.

- Motorcycles (up to 350cc): Dropped from 28% to 18%.

- Education:

- Maps, charts, globes: Reduced from 12% to 0%.

- Exercise books: Lowered from 12% to 0%.

- Electronics:

- Air conditioners: Cut from 28% to 18%.

- Monitors and projectors: Reduced from 28% to 18%.

These adjustments, highlighted in PIB posts, aim to boost consumption and support key industries.

Process Reforms for Better Compliance

The reform isn’t just about rates. It introduces process improvements to ease business operations:

- Registration: Automatic approval within 3 working days for applicants.

- Refund: System-based provisional refunds with risk evaluation.

- Benefits: Focus on zero-rated supplies and inverted duty structures.

Small businesses with turnovers above ₹2.5 lakh monthly can opt into a simplified scheme. This reduces paperwork and speeds up tax credits, as noted in recent updates.

Impact on Everyday Life

These changes will directly affect consumers. Lower rates on essentials mean:

- Cheaper daily items like shampoo and butter.

- Free health insurance could encourage more coverage.

- Affordable cars and bikes may boost purchases.

Businesses, especially in agriculture and manufacturing, benefit from reduced input costs. The real estate sector sees gains with cement now at 18% (down from 28%). However, savings depend on companies passing on the benefits.

Read This Also: Elon Musk’s Journey from South Africa to Silicon Valley: A Self-Made Billionaire’s Rise

Economic Boost and Challenges

The government expects economic growth from this reform. Benefits include:

- Increased consumption due to lower prices.

- A wider tax base with improved compliance.

- Revenue offset through higher demand.

Finance Minister Pralhad Joshi emphasized support for farmers and MSMEs. Yet, challenges loom:

- Initial revenue loss could strain state budgets.

- Businesses need time to adjust pricing.

- The 40% luxury tax might face legal scrutiny.

States like West Bengal have raised concerns, but the Centre holds firm on the structure.

Insights from Today’s News

Today’s news, including PIB posts on X, reflects the reform’s scope. The ₹1,500 crore scheme for critical mineral recycling ties into GST’s industrial focus. Union Minister Piyush Goyal’s comments at the Bharat Nutraverse Expo 2025 highlight how GST cuts will boost consumption. These updates align with the government’s Diwali 2025 gift promise.

Sector-Specific Gains

Different sectors see tailored benefits:

- Agriculture: Lower rates on tractors and irrigation aid farmers.

- Healthcare: Tax-free insurance benefits patients.

- Education: Free books support students.

- Automotive: Cheaper vehicles could revive sales.

- Electronics: Affordable appliances drive household spending.

These targeted reductions address sector needs effectively.

Looking Ahead

The reform paves the way for GST 2.0. Future steps include:

- A task force to suggest long-term changes.

- Ongoing Council meetings to refine the system.

- Continued focus on compliance ease.

The September 22 rollout coincides with Diwali, fulfilling a key pledge.

How to Stay Informed

Consumers and businesses should stay updated. Try these steps:

- Visit the GST portal (cbic-gst.gov.in) for details.

- Consult tax professionals for guidance.

- Follow GST Council announcements.

The 56th meeting’s decisions set a new direction. Stay proactive to benefit.

Final Thoughts

The 2025 GST slab reforms mark a turning point for India’s tax system. With rates dropping to 0%, 5%, and 18% for most goods, and relief in healthcare, education, and agriculture, the changes promise a better quality of life. The 40% slab on luxury items ensures revenue stability. Despite challenges, the focus on self-reliance and ease of living could drive growth. As September 22 nears, this Diwali gift could reshape spending and investment. Keep track of updates to maximize the advantages.